A Downwardly Mobile Retirement

During the Golden Age of the US Middle Class, Hollywood often portrayed retirement as that time when an employee received a memorable gold watch for decades of loyal service and then headed off to some warmer clime to enjoy the “twilight years”. That is no longer the case. Today’s retirees face a downwardly mobile retirement… and usually no gold watch as well.

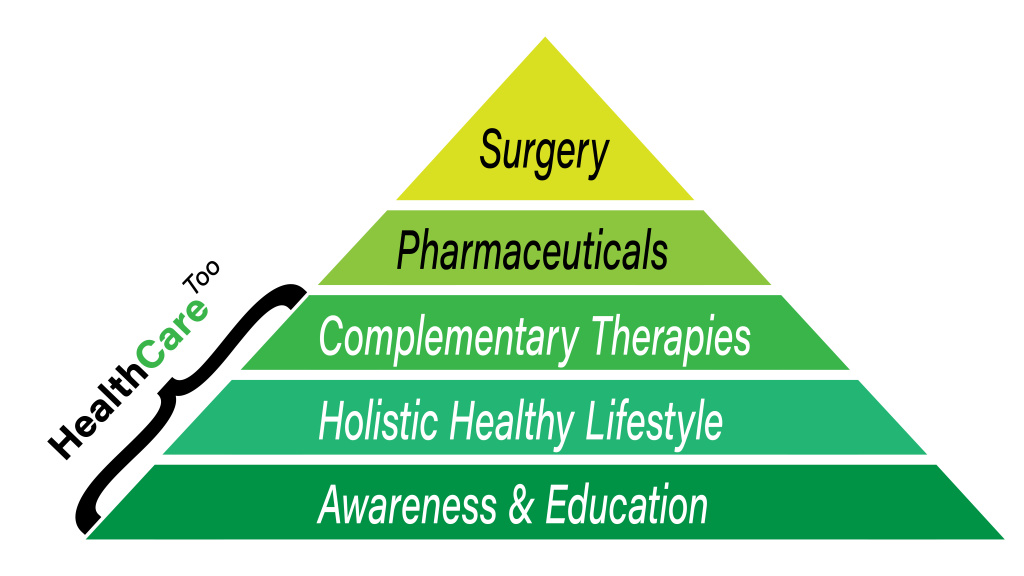

At HealthCare Too, not only do we view financial health as a part of a holistic approach to healthcare but we also promote reducing the cost of sick care through improved Lifestyle and prevention. Investing in healthcare is far preferable and less expensive than continuing to pay for sick care.

Most financial experts agree that a retirement crisis is either looming on the horizon or already here, due to Americans’ insufficient savings.

The Schwartz Center for Economic Policy Analysis at the New School estimates that roughly 40% of Americans, or 2 out of every 5 who are currently considered ‘middle-class’ based on their income, will fall into poverty or near poverty by the time they reach 65.

The authors of the study defined middle class as an individual or couple earning more than twice the federal poverty level before age 65 (currently $12,140 for an individual, $16,460 for a couple) and then earning less than that threshold after age 65.

Lead researcher Teresa Ghilarducci, using data from the US Census Bureau, predicts that 8.5 million middle-class older workers and their spouses will be downwardly mobile in retirement, falling into poverty or near poverty after reaching 65.

And the risk increases as people get older. Those over 80 are 30% more likely to be poor than those aged 65-69.

She cites three main reasons that the risk of poverty increases as retirees get older: depressed earnings, decreased asset values, and increases in health care costs, which are all likely to accelerate future old-age poverty rates.

Related to these factors is an additional issue. The most common age for retirement is 62, the earliest possible age to begin receiving Social Security. Although most people plan to work until 65 or later, about half of people who retire sooner than they had planned do so because of events beyond their control — their own health issues or needing to provide caretaking for a loved one, or getting laid off from a job and being unable to find another one.

Source: Almost half of middle-class Americans face downward mobility in retirement | BenefitsPRO