Payers Pursue Holistic Health Solutions

Payers have developed several initiatives to incorporate preventive care and wellness as part of their larger holistic health solutions.

Adding wellness and preventive care can help payers keep their beneficiaries from developing costly chronic conditions and improving their overall health.

Employers recently expressed high interest in wellness and preventive care investments. Wellness and preventive care programs could also provide added value to payers that sell employer-sponsored insurance options.

Aetna, BlueCross BlueShield, and Kaiser Permanente have recently contributed research, digital, and fiscal resources towards developing novel wellness and preventive care programs for health plan members.

For more read the original article: Payers Add Preventive Care, Wellness to Holistic Health Solutions

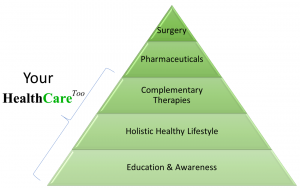

Our Model